Is Now a Good Time to Buy a Home or Should I Wait Until Spring?

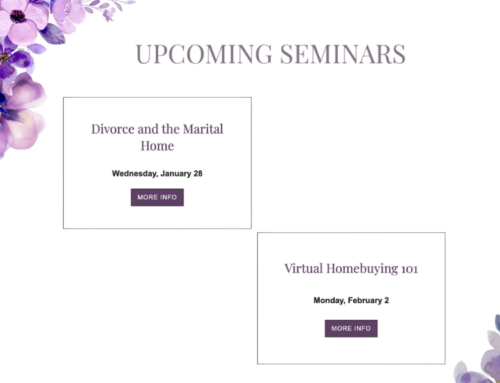

As you can imagine, I get asked this question frequently: “Should I wait to buy a home until next year when interest rates are (hopefully) lower?” So, in preparation for my upcoming Homebuyer 101, I crunched some numbers to help clients decide whether to buy now or wait for lower interest rates.

In the real estate world, there is a saying that you marry the price and date the rate. Once interest rates come down, most of us predict that there will be a flood of buyers. Today, most of the purchases I work on have little or no competition and are purchased at the list price or even lower than list. If there is a flood of buyers, then we are back to crazy times with increased competition for each house, multiple offers, waiving contingencies, and escalation clauses.

How does that impact the numbers? If you bought a house today for $500,000 and put 3% down, your monthly payment would be around $4000. If instead you waited until next year and rates came down a percent, but you paid $550,000 for that same house, your monthly payment would be around $3900. So it seems like you should wait. However, you can always refinance that loan for the $500,000 house if rates come down, and then your monthly payment would be around $3600. So waiting did not help because you paid $50,000 more for the same house and ended up with a $300/month higher payment!

Of course, all of these numbers are based on predictions, but I found them compelling. I was not sure what to expect when I started. If you (or your children) want to learn more, please email me or fill out the form on our contact page.