Millennial (and Gen Z) Renters, Listen Up!

As our Home Buying 101 seminar approaches, I (Patrick) would like to share my experience from the first Home Buying 101 seminar I attended back in 2017, early in my relationship with Mark, Margie’s son.

The first question Margie asks during the seminar is “When do you plan to buy?” Mark answered first, “Likely within two years.” I couldn’t even fathom buying a parking spot in DC within that timeframe, much less a home, having recently moved to the very expensive DC market from South Dakota. So, when it was my time to answer, I said I didn’t imagine buying for at least five years. This elicited a bit of confusion and laughter, as Mark and I were living together, and buying a home together would be a natural next step in our relationship.

Both Mark and I wanted to buy to escape our small English basement, where Mark had to duck when moving between the stove and the kitchen sink or risk hitting his head on the ductwork. Like many people do, we often perused Zillow, looking at condos that felt like a dream. Social media and the news had conditioned us to believe that purchasing a home, especially as millennials, would be difficult, if not impossible. After all, we regularly indulged in avocado toast.

What I learned in that first seminar completely changed my perspective. My student loans did not preclude me from buying. We did not need to save enough money to have a 20% down payment, and private mortgage insurance at lower down payment amounts was not cost-prohibitive. The difficulties millennials faced in affording homes due to the rising cost of housing and stagnant wages led to the development of federal and local programs aimed at helping first-time and lower-income homebuyers.

The evening after the seminar, armed with our new mortgage knowledge, with a condo listing that felt like a dream glowing on the computer screen in front of us, Mark and I discussed how buying in the short term could be a possibility. We set up a meeting with Margie to go over our specific income and financial situation, and soon realized the dream was within reach. We closed on that condo within a few months.

My “at least five years” had turned into less than five months. Had I not attended that seminar, I would have continued to rent, wasting over $120,000 over the past eight years. Mark and I have instead built $60,000 of equity in our condo and have had inflation-proof housing, while others have dealt with significant rent increases.

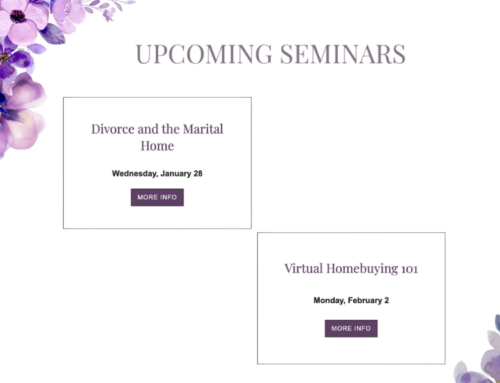

I encourage anyone who wants to buy but is under the impression that buying is out of reach to attend our seminar on October 22nd. I know many of our readers are past clients, so I encourage you to forward this to a friend or family member who could benefit from the knowledge we will share at our upcoming seminar. For more information and to RSVP for the seminar, please click here.